How MENA Is Shaping to Become the New Marketing Hub by 2025

Published on: 23 Sep 2022 | Author: Anne-Gaëlle Sy

Published on: 23 Sep 2022 | Author: Anne-Gaëlle Sy

In recent years, the MENA region (Middle East and Northern Africa) has seen exponential growth in the world of marketing and is currently the second-fastest growing market of eCommerce in the world. For example, digital advertising expenditure was at 1,156 million USD in 2018 compared to the 5,579 million USD expected this year.

At Sortlist, this is something we have observed over the past few years in our own data via thousands of agency projects in the region.

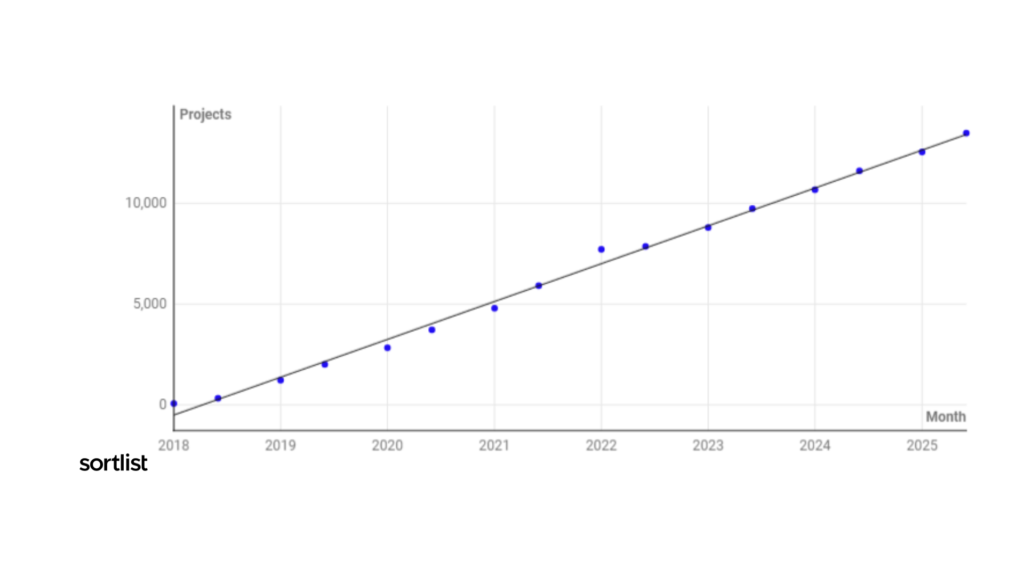

Not only have we seen this significant growth in marketing expertise investments via the number of projects we receive in the region (an increase of 285% in 3 years) but we can also notice it via the 374% growth in MRR in the past 3 years that now accounts for 5% of our total business revenue.

With these observations, we wanted to investigate how marketing trends in MENA are making it a hub for both clients and marketing agencies alike, but also prospect what the next years will look like based on the current growth trend.

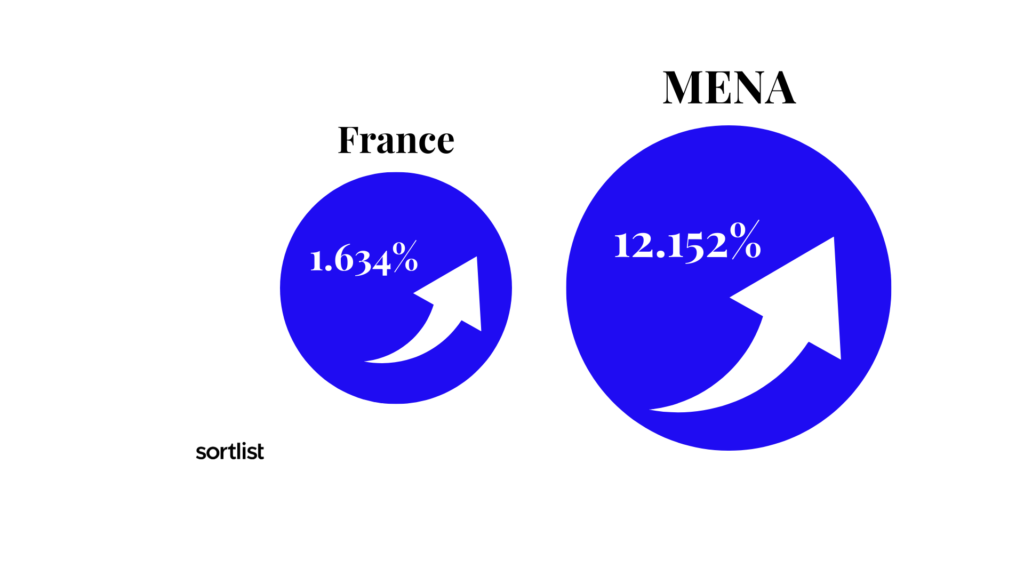

Between January 2018 and January 2022, our top 5 countries in the MENA region (UAE, Morocco, Tunisia, Saudi Arabia, and Egypt) went from 63 total projects to 7719; a 12,152% growth in just 3 years.

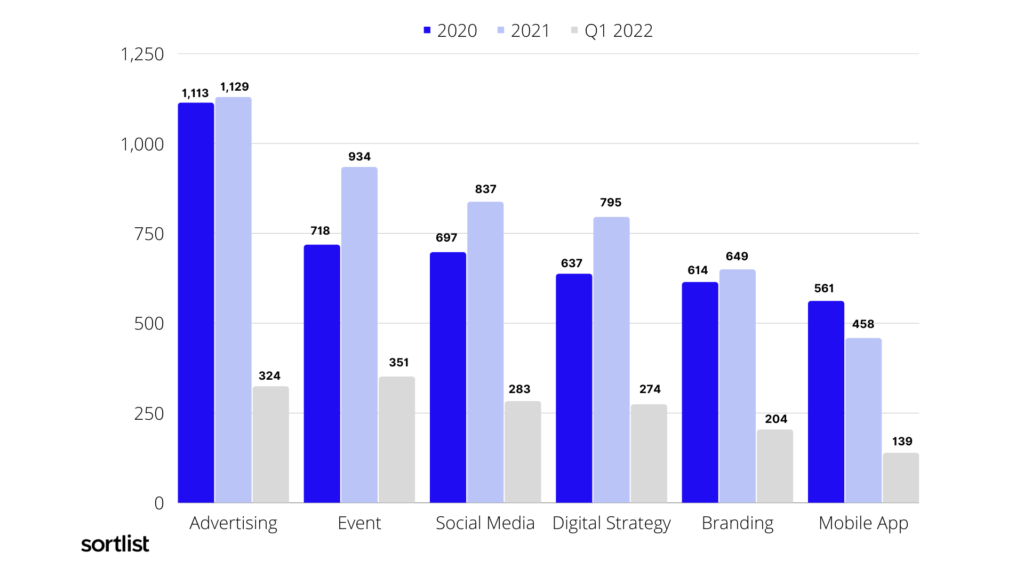

With 637 total digital strategy projects in 2020, and 795 in 2021, Sortlist saw an increase of almost 25% of projects in just one year.

In comparison, in the same time frame, our biggest market and country with the biggest share of our MRR, France, saw an increase of 1,634% of projects….

This is something we are obviously very proud of, but that also highlights just how many more companies in the MENA region are looking for marketing expertises and therefore opportunities.

With this continued trend, we should expect to start off 2025 with 13,491 total projects sent to our partner agencies.

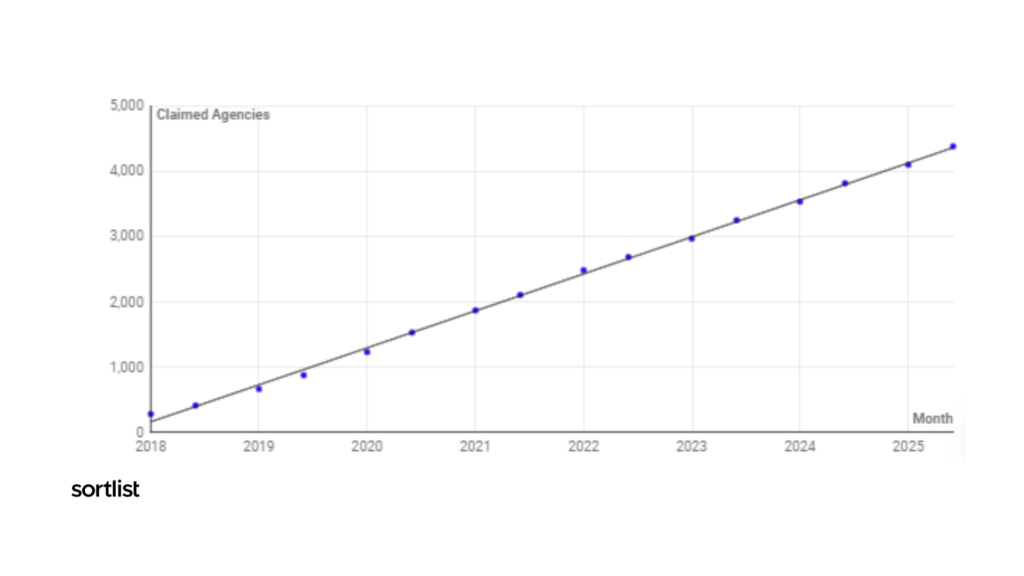

But not only have we been able to observe growth via projects, but also through our partnering agencies.

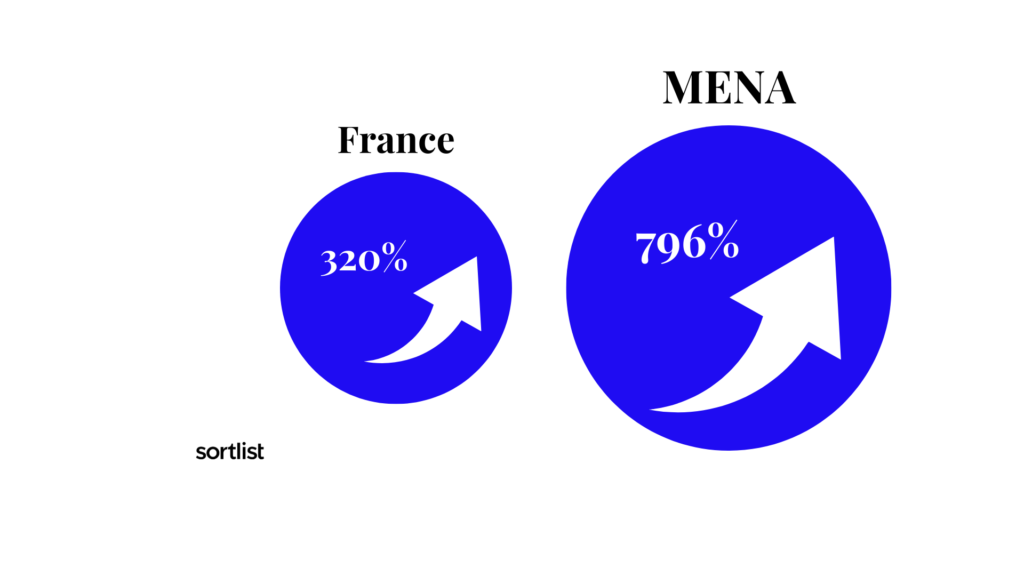

In the past 3 years, Sortlist went from 277 claimed agencies in our top 5 MENA countries, to 2484 in January 2022.

The number of marketing agencies growing in the region follows the parallel tendencies of projects coming in and proving that the Middle East and Northern Africa are increasingly commercially relevant on a global scale.

Once again, to put these numbers in perspective, in France, with 5052 claimed agencies in January 2022, there was an increase of 320% claimed agencies since January 2018. In MENA, we have seen a 796% increase in the same amount of time.

Clients and agencies alike are growing at an exponential rate all across the MENA region. Clients are looking for their projects to be carried out and aren’t short of agencies around them to take charge.

As we mentioned previously, 90% of companies are still focusing their marketing efforts on North America and Western Europe, but this trend doesn’t seem like it will last.

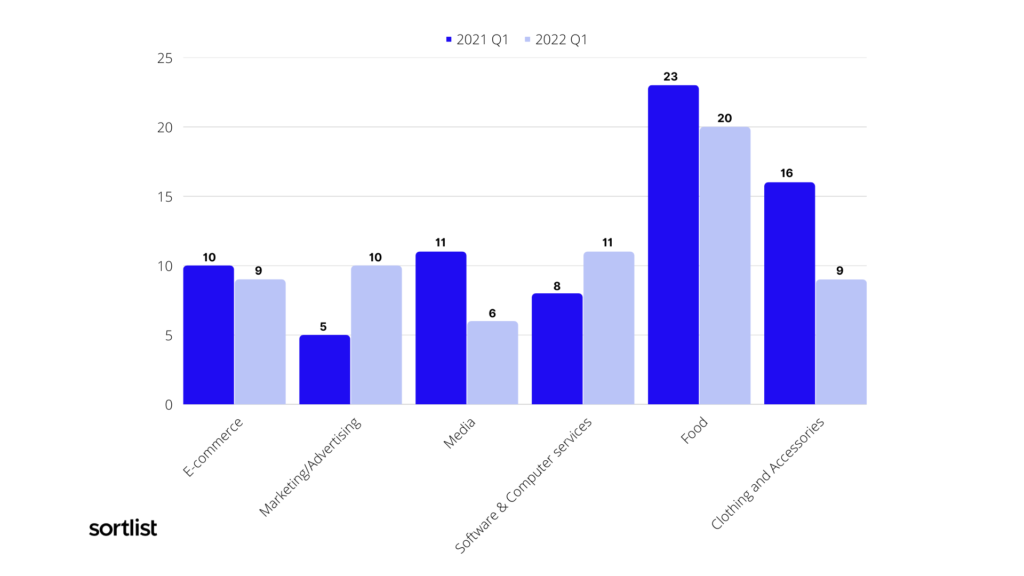

Here are the top current top 5 marketing expertises in the UAE, Morocco, Tunisia, Saudi Arabia, and Egypt:

Advertising has seen a steady influx of projects coming through in recent years.

But with the rise of digitalization and the ‘party hub’ that has become of Dubai, it is no surprise that we have seen not only an increase in projects for events, social media, and digital strategy but also a promising trend for the rest of 2022.

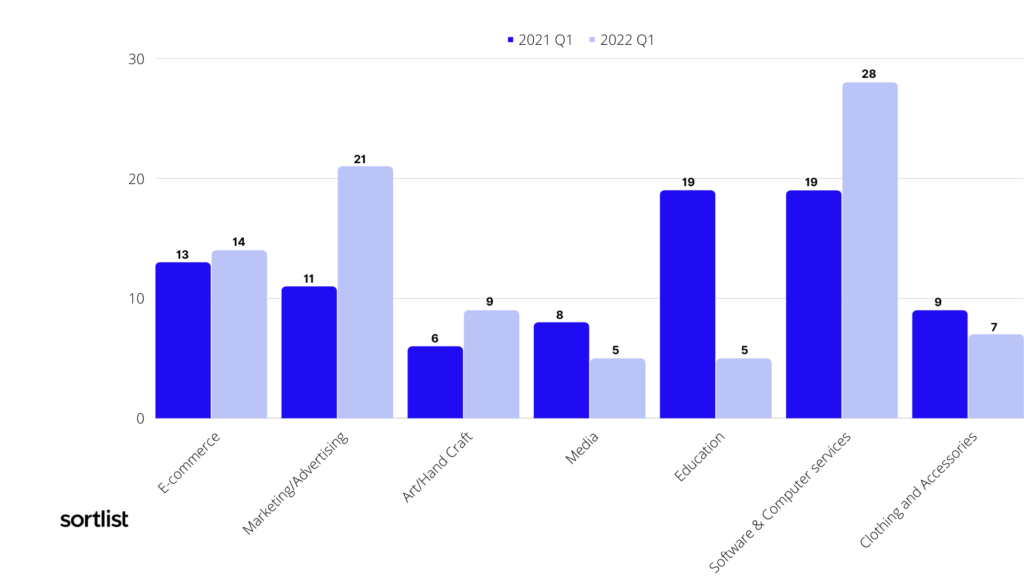

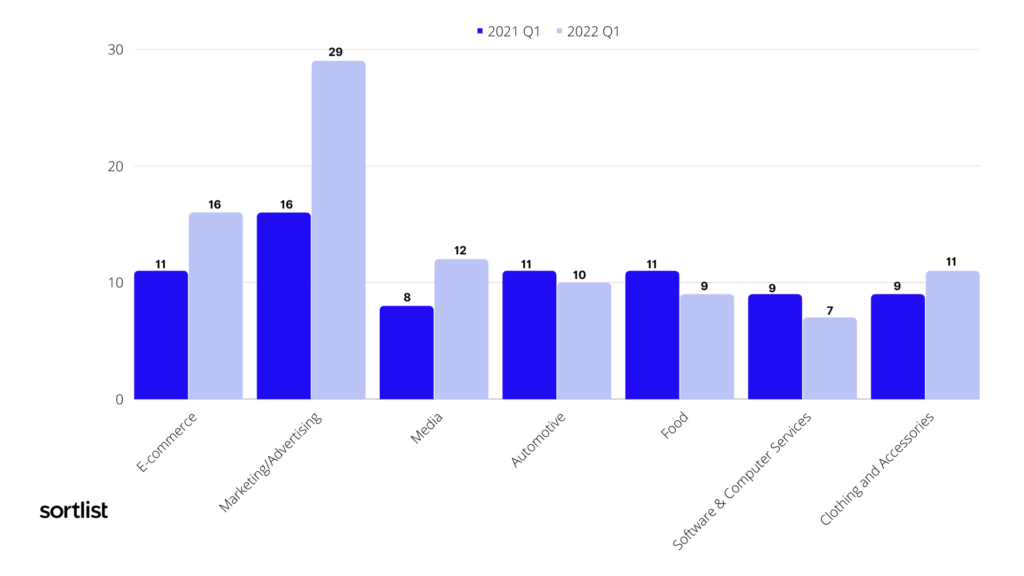

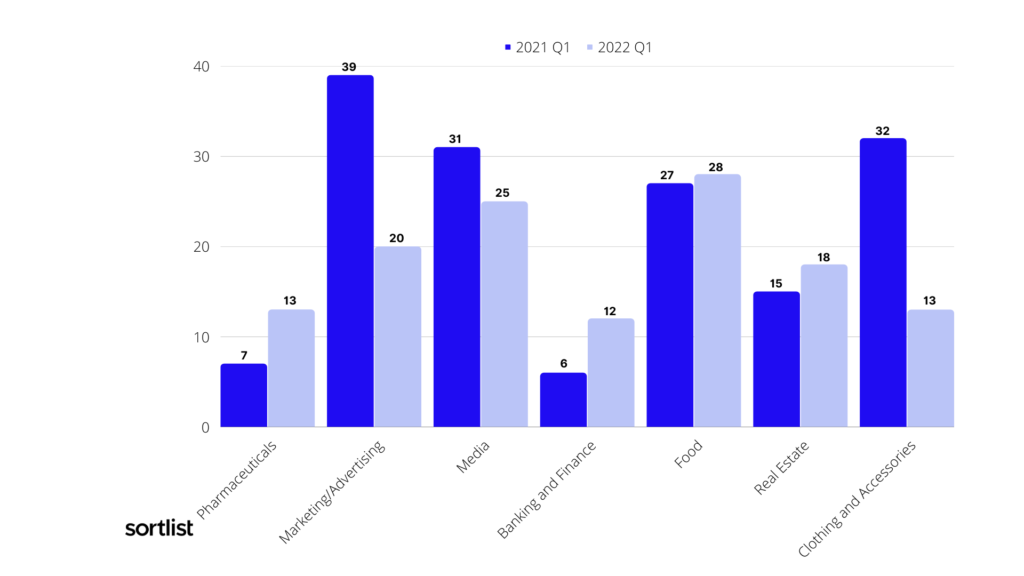

But although put together to create a global top 5 expertises in the MENA region, some expertises are much more prominent in some areas than in others.

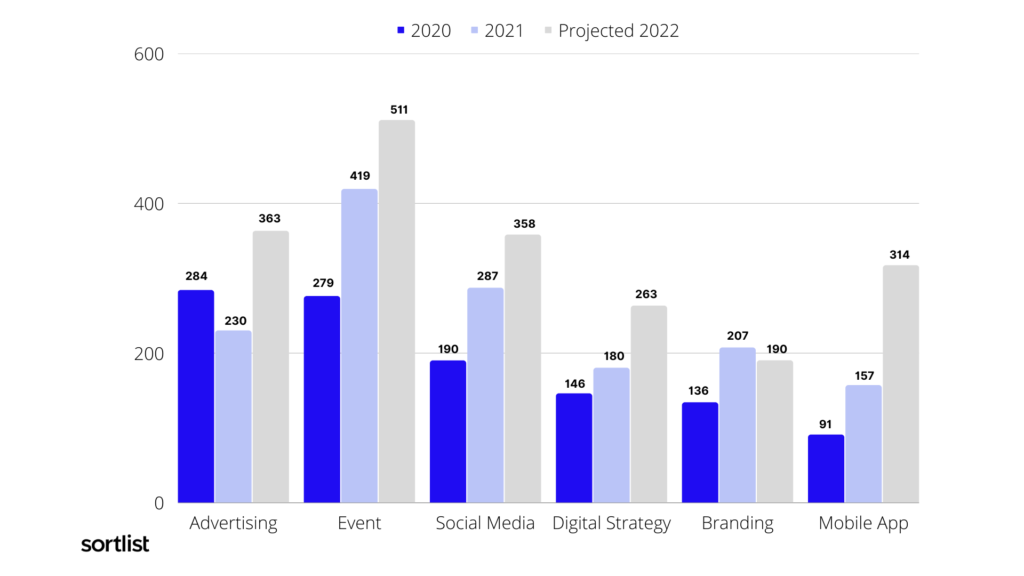

The first quarter of 2022 is also promising in terms of event projects with a higher number this time around compared to the same period last year.

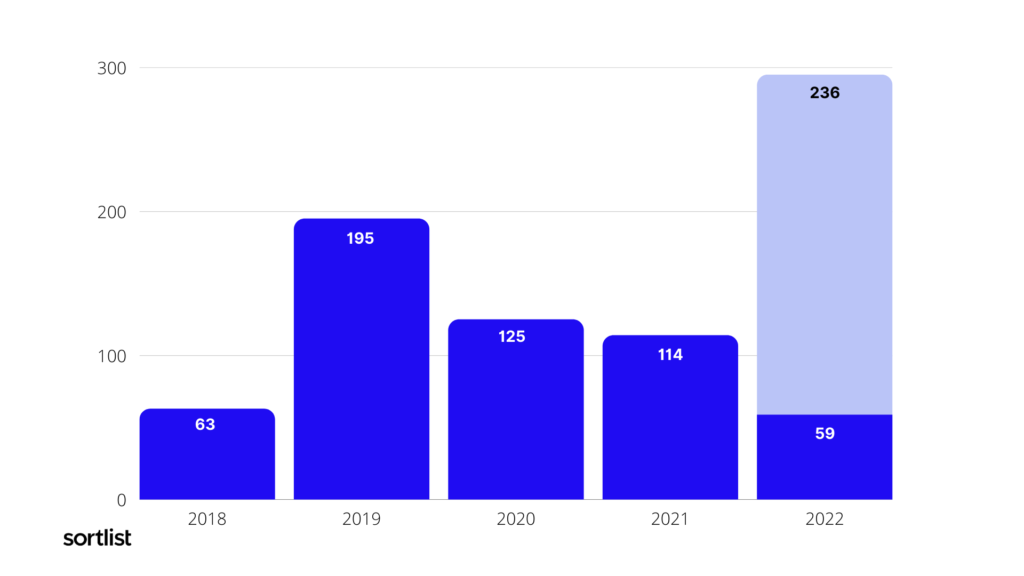

Above you can see a chart that predicts the number of projects we will finish with by the end of 2022 based on Q1 results vs Q1 of previous years.

Companies were and are taking advantage of this kind of marketing in this part of the world that has accommodated its venues and backdrops to host events. What better way after having been locked up in our homes for months than to finally get back out and meet people in person?

But nowadays, a major positive factor to any event is that it is virtually impossible for them to go unnoticed…#thepowerofsocialmedia

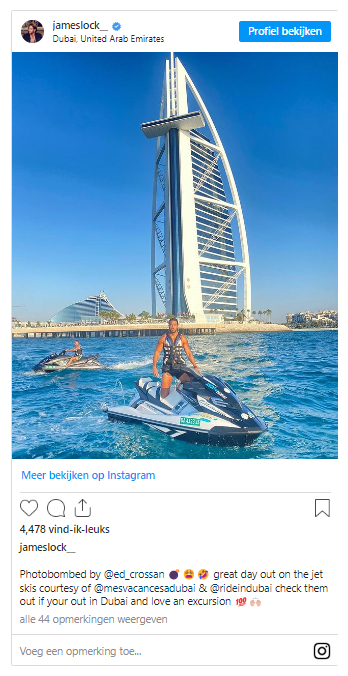

“Already built on the illusion of unlimited indulgence, Dubai has at times appeared a parallel universe as other countries wrestled with Covid lockdowns […] until the UK imposed a quarantine for returning passengers, British influencers scrambled to justify exercising with a view of the Dubai marina, or smoking shisha in a pool, as “essential work”.

Their claims may have looked delusional to their followers in the UK, but in Dubai they were a welcome addition to the flocks whose bronzed selfies present the city’s ideal face.”

– The Guardian

Any event that doesn’t post on social media is losing out on major visibility. That is why these two expertises almost go hand in hand with each other.

When we think back to the countless influencers showing off their luxurious travels around Dubai or Abu Dhabi, they all use social media platforms to attract a certain type of clientele; young and potentially wealthy individuals ready to spend some money.

But it is not just for their own national audiences that countries like the UAE are investing in influencer marketing and social media marketing. International companies often come and use the backdrops of cities like Dubai to market their products.

“Once a small port on the edge of a desert, Dubai has become a global hub of influencer culture, a magnet for social media stars desperate to tweak their image in what has become the ideal Instagram city…Everything the eye lands on in Dubai was created for a purpose; nothing is natural or accidental, from the smooth skyscrapers to the purpose-built islands that function as gated communities. Dubai’s planners are now consciously building with the Instagram aesthetic in mind.”

– The Guardian

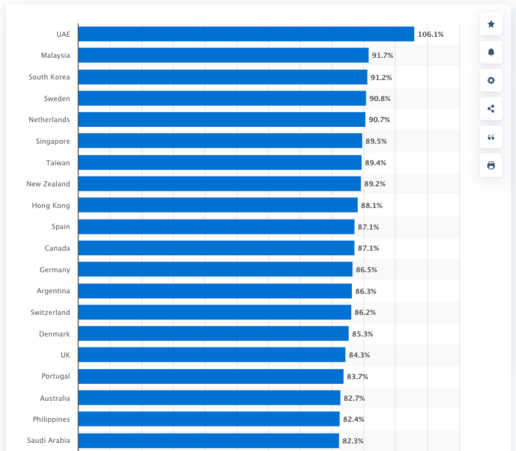

According to a recent study, since January 2022, the UAE has had the world’s highest social media use rate with no less than 106.1% of the population active on social media (can be explained by some users having multiple accounts on a platform).

Beyond the UAE, social media users in MENA (along with Latin America) are those that spend the most amount of time per day with an average of 3.5 hours on their average 8.5 accounts.

As a marketing agency in MENA, with the immense amount of potential, offering social media services is an advantageous way of collaborating with clients.

On the other hand, as a company looking to advertise, social media marketing can prove to be much more powerful in this part of the world than anywhere else, and it is no surprise that this marketing expertise is in such high demand.

Companies looking for an audience that transcends all generations and where they have 3.5 hours of potential visibility per person per day…it’s worth the investment don’t you think?

“The value of internet advertising expenditure in the region is expected to increase at a steady pace. For instance, according to a study by Zenith, the value of internet advertising expenditure in the Middle East and North Africa in 2022 is expected to reach USD 1,205 million.”

– Mordor Intelligence

Social media marketing is naturally one of the newest forms of marketing. With the rise of technology and our growing need to always be connected with one another, companies have started to alter their ways of approaching their public.

Advertising has always been one of the most common ways for companies to market themselves. Whether it be OOH, on the television, or in magazines, companies are now having to build an online advertising strategy to keep up with modern trends.

But today, on top of advertising, companies are having to invest more in their overall digital strategy, especially in MENA. With a faster growth of internet users in the region compared to the rest of the world, it is almost impossible to not have a solid digital strategy.

“It seems like a case where there are so many advertising agencies that are coming up all over even just Cairo itself and they’re all incredibly busy. It’s just a matter of one company seeing that their main competitors in the market are outsourcing their advertising so they will just tend to kind of follow suit and do the same, and it seems to be the easiest way of doing it.”

– MWG

“Accelerated by the pandemic, 87% of MENA companies are undertaking substantial business and technology transformations to stay relevant and accelerate growth. The application of technology has made MENA corporates more productive, promoting a gestalt that COVID-19 has triggered the beginning of a widespread digital makeover across sectors.”

– EY

Which industries have taken advantage of this new and upcoming marketing hub in the MENA region?

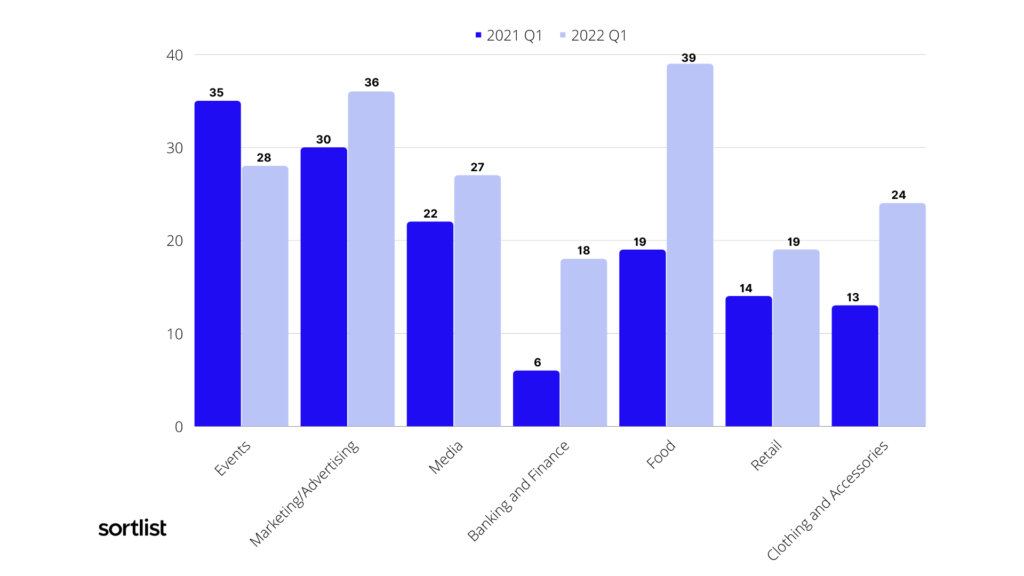

Ironically, it is not only marketing, advertising, and event expertises that are in demand, but they are also the industries that are looking to agencies for more marketing help. But it would be unfair to group the event industry in the UAE along with all the other industries in the other 4 countries from its sheer over-towering numbers compared to the rest.

In 2021, event companies saw a competitive advantage to relaunch their industry and took the opportunity to invest. We can see that this advantage has lessened in 2022, but it’s still an important pillar of the economy in the region.

Now that most of the world is starting to open back up their borders and event spaces, the MENA region is no longer the only one businesses can turn to. Nevertheless, they are still a point of reference for many looking to stage their events.

A prominent industry many may find surprising as a key player in the economy of the marketing world in the MENA region is the food industry.

After a 210% increase in projects from 2018 to 2019, we were expecting to see the exponential growth continue into the next years.

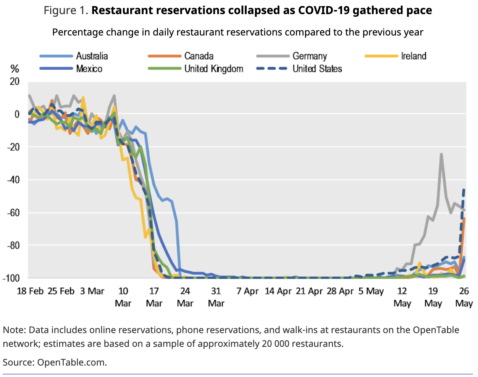

Unfortunately, due to the COVID-19 pandemic, we all witnessed the food and beverage industry receive a massive blow, and conclusively, project numbers went down.

However, we are now witnessing a light at the end of the tunnel.

After just the 1st quarter of 2022, we have already received 59 projects coming from the food industry; the largest amount we have ever received in previous years in the same time period. If the MENA region is looking to continue this trend, we are expecting to finish this year on a new all-time high.

“Middle East consumers are developing an appetite for new international foods, flavors, and tastes, which have become accessible due to globalization. During the early days of the pandemic, expats in the region wanted to have a taste of home – recreating some of the recipes they learned through WhatsApp calls with family… The food industry trends in the Middle East are driven by increased choices and options, social media, government-supported awareness campaigns, and eco-conscious consumption. During Gulfood 2022, the largest expo for the Middle East food industry, F&B brands showed that they recognize consumers’ needs for healthier, sustainable, and nutritious food. “

– Talkwalker

One of our success stories was between Kafa Coffee and the event and marketing agency Markable. Thanks to Sortlist, the client and agency got together and collaborated on a project that showcased Kafa Coffee’s at an exhibition stand for EXPO 2020 in Dubai.

The F&B industry is having to evolve rapidly to the changes in demands and with an increase in the competition, they are having to stand out amongst the expanding crowd. But not only that…consumer interactions have changed drastically as well since the pandemic.

Having a restaurant and attracting new clientele is now all about the digital brand you have created for yourself.

New customers won’t necessarily come and eat at a restaurant because they walked past it one day, instead, it will be because they see it online somewhere or someone recommended it to them, and on top of that, they may want to sit comfortably on their couch and have the food delivered to them.

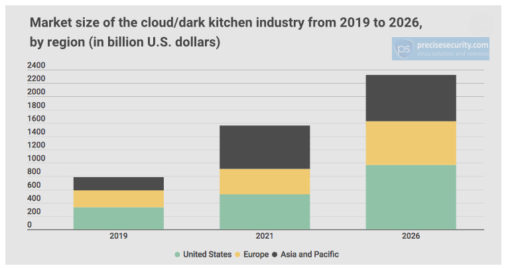

How does the F and B industry adapt to this change? Digitalization, ghost kitchens, and smart investments.

Google is no longer the reference for customers to find new restaurants. The Food and Beverage industry has had to adapt its marketing ways to new and more attractive platforms.

But going digital isn’t the only way the F&B industry has had to evolve…

Ahemd continued: “A big number of restaurants started to go cloud. A lot of restaurants started other brands, sub-brand as a cloud kitchen. A cloud kitchen is a kitchen that doesn’t exist on the ground, but it is someplace where they cook the food, and they just deliver. The number of restaurants that actually opened virtually now has increased more than 30-40%.”

“Talabat, Zomato, Deliveroo, Uber…those four apps they control almost 80% of the delivery and food and restaurant locations in the UAE. Because we were not really going out during Covid, people started using mobile applications. So a lot of restaurants started to move from just how you do things by referrals to listing themselves and going with the flow and that is the first step to go digital.”

– Ahmed Taha, Digital Director at Outreach

We’ve been lucky to witness such a wealth of marketing growth in the MENA region over the past 3 years and 2022 is promising to show this continued exponential growth.

Companies and agencies alike have found prospects that this region has in comparison to the traditional Western European and North American marketing practices and audiences that we have always followed and decided to take on new opportunities.

Sortlist’s very own MENA sales manager, Karim Saadoune has said that if there is one word to describe this region in marketing is: potential.

With the rise in projects and agencies alike throughout the past 3 years, our company is believing more and more in MENA. We have started to invest in our involvement in the region by even opening up our first local office in Tunisia, and we hope to expand the team by double come the end of the year and also our revenue.

The Sortlist Data Hub is the place to be for journalists and industry leaders who seek data-driven reports from the marketing world, gathered from our surveys, partner collaborations, and internal data of more than 50,000 industries.

It is designed to be a space where the numbers on marketing are turned into easy-to-read reports and studies.