Have You Thought About Efficiency? Calculate Your Conversion Cost

Last update: 14 November 2023 at 02:12 pm

Inventory-producing companies rely significantly on specific indicators to measure production and assess how efficiently inventory is generated and sold. Conversion costs are one of the most often used measures for this.

This statistic measures the costs of converting raw resources into marketable inventories. In this post, we’ll go over what conversion costs are and try to know more about them in a detailed way.

What Are Conversion Costs?

Conversion costs are the total direct labor and factory overhead costs.

When a firm converts raw material into a finished product, it incurs conversion costs in the form of overhead and labor.

Calculating and understanding your company’s conversion costs will help you have a better understanding of how much you spend on inventory manufacturing.

Managers and other supervisors can use conversion costs to properly assess and track production costs. Conversion costs may also be used to build market based pricing models for items and to estimate the final worth of finished goods.

Conversion costs may also be used by business owners or managers to evaluate whether there is any waste that can be avoided and to better understand the efficiency of their manufacturing process.

Conversion costs are most commonly utilized in the manufacturing industry, although any company that manufactures items can use this statistic when making business choices connected to their products.

In addition, a firm may be required to compute conversion expenses to estimate its cost of sales for income statement reporting.

How to Calculate Conversion Cost

The formula to calculate conversion costs for determining conversion expenses is as follows:

Direct labor + manufacturing overhead costs = conversion costs

Let us understand the direct labor and manufacturing overhead expenses mentioned in the formula for conversion costs a bit more clearly.

Direct Labor

The costs of the employees who make the goods are known as direct labor expenses. Wages, worker insurance expenses, pension fund payments, bonuses, and any other expenditures linked with the hired workers participating in the manufacturing process are all examples of this.

These direct labor expenses are the same ones that go into determining the manufacturing prime cost.

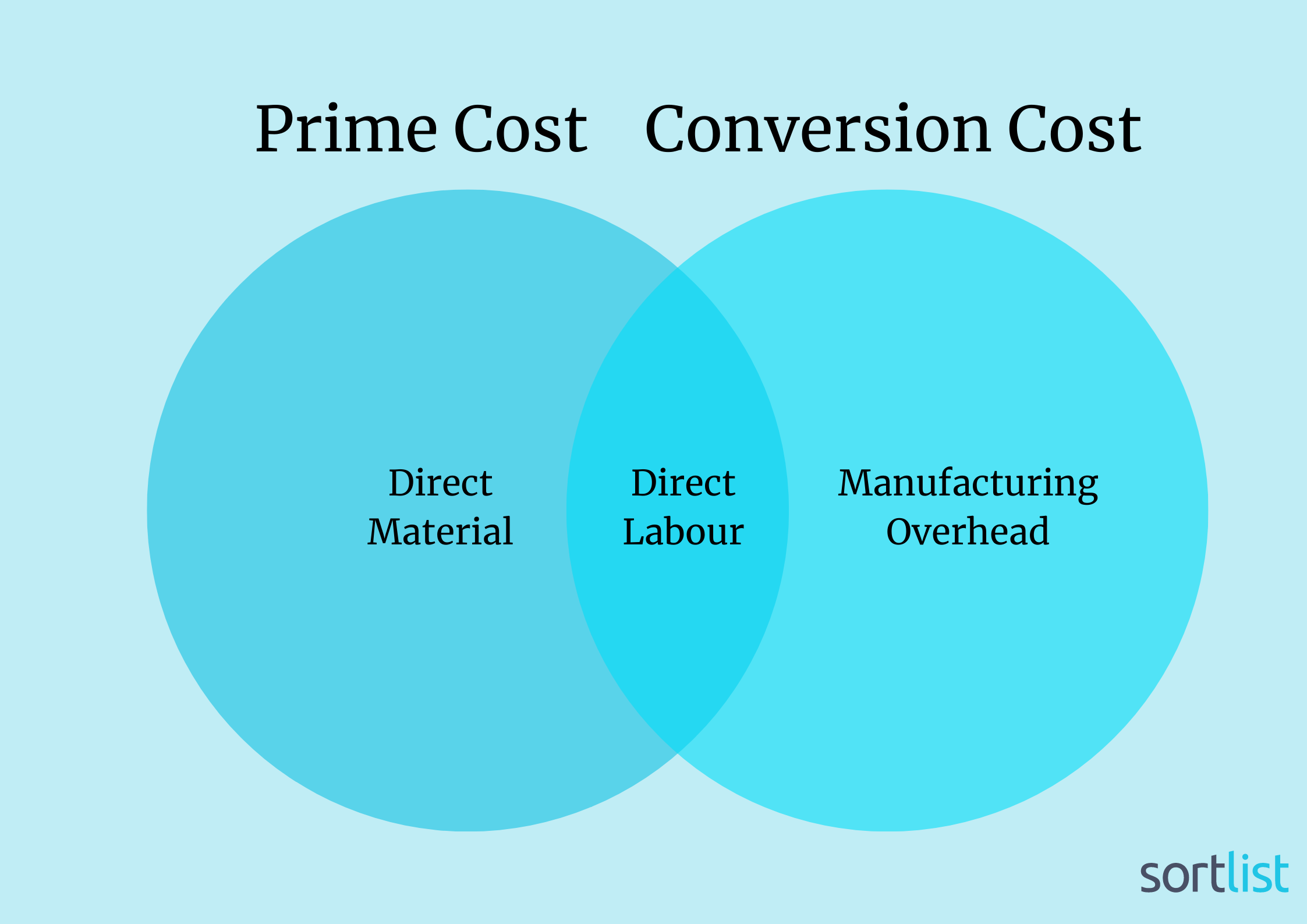

Direct labor is included in both the prime and conversion expenses. The sum of the two direct product costs: direct materials and direct labor expenses, is known as prime costs.

Conversion costs include direct labor expenses and manufacturing overhead costs that are required to transform direct materials into finished goods.

Manufacturing Overhead Costs

Manufacturing overhead costs, such as rent or electricity, are used in the calculation of conversion costs because they cannot be attributed to the production process or a single unit in production.

These expenses cannot be attributed to a single unit of manufacturing.

Manufacturing overhead costs can’t be linked to a particular item in the manufacturing process. Insurance, building upkeep, machine maintenance, taxes, equipment depreciation, machining, and inspection are all examples of manufacturing overheads.

Importance Of Conversion Cost

A company’s accounting and production management compute these conversion costs to estimate production costs, the value of finished and unfinished inventories, and create product pricing models.

Conversion cost is used to assess the efficiency of manufacturing processes, but they also account for overheads in the production process that aren’t included in prime costs.

Conversion cost is often used by operations managers to determine if there is any waste in the production process.

If a company encounters an unexpected expense while calculating the conversion cost, it should not be included because it is not a typical cost. Any manufacturing cost that does not include the direct cost of raw materials is referred to as conversion expenses.

The following are some of the most frequent conversion charges that a business can face:

- Employee advantages

- Salary

- Wages

- Taxes on wages

- Expenses for production utilities

- Depreciation of equipment

- Costs of equipment upkeep

- Rent for a factory or an office

- Factory insruance, for example is a type of prodcution insurance

- Supervision

- Costs of inspection

- Machining

- Bonuses for employees

- Contributions to a pension

- Small instruments that are billed seperately

Prime Cost Vs. Conversion Cost

Although prime and conversion expenses are linked, they are not the same. A prime cost is any expense that is directly connected to the development of completed inventories, whereas conversion costs are the costs associated with converting raw materials into a finished product.

Direct materials and direct labor charges are both included in prime costs when creating full items. The acquisition of raw materials or any physical element required to produce a product is referred to as direct materials.

Because it is necessary to construct a whole automobile, the axle of a car, for example, would be regarded as a direct material.

The formula for determining the prime cost is as follows:

Prime costs = raw materials + direct labor

Only expenditures directly connected to employees who participated in the development of final items are included indirect labor costs.

The salaries paid to a painter, for example, would be included in the prime costs if the painter was contracted to paint the automobile being built.

Some of the charges are shared by both prime and conversion costs. Both prime and conversion expenses, for example, will include direct labor costs in their estimates.

Prime costs, unlike conversion costs, do not include any indirect labor expenses associated with production. Both of these measures may be used to assess a company’s manufacturing efficiency, but they provide different information.

Example Of How Conversion Costs Work

Consider the following example from Company A: During April, the firm spent $50,000 on direct labor and related expenditures, plus $86,000 on factory overhead costs.

Let’s say Company A produces 20,000 units in April.

As a result, the company’s conversion expenses per unit for April were $136,000 in total conversion costs divided by 20,000 units produced = $6.80

An Example Of Prime Costs In Action

Consider the case of a skilled furniture builder who has been paid to build a coffee table for a client.

The table’s primary expenditures include the labor of the furniture manufacturer as well as the raw materials needed to create the table, such as timber, fasteners, and paint.

Assume that the basic components, such as timber, hardware, and paint, cost $200.

The furniture maker’s labor rate is $50 per hour, and this item will take three hours to complete.

The table’s total cost is $350 ($200 for raw materials + $50 x 3 hours of work = $150 in direct labor). The furniture producer needs to charge at least $151 to be profitable.

Summing Up

Every firm must calculate conversion costs since they help with critical business choices such as setting the price of a product, calculating the cost of sales for use in the income statement, inventory value, and so on.

Conversion costs are computed to determine the cost per unit, which helps the firm determine product pricing. The conversion cost is also used to calculate the cost of sales, which is shown on the income statement. Since closing inventory is a line item recorded on both the income statement and the balance sheet of the firm, estimating its value is simple.