How Your Marketing Team Should Invest in Their Summer Body | Q1 + Q2 Analysis

Last update: 16 February 2023 at 11:57 am

It’s not just humans that get themselves ready for the summer. Marketing investments also pack in the work before the months of July and August where they relax, make the most of the hard work done, and get ready for the new quarters ahead. Find out what the future of marketing has to offer!

In 2021 more than ever, marketing is a must and we’re seeing an increase in the number of companies investing in it.

Before entering the summer months slow-down, since January 1st, 2021, Sortlist has received more than 12,800 projects from companies looking for a digital marketing agency.

Compared to the same period last year, that’s an increase of almost 22%. Each month, more than 2,000 companies post a project on Sortlist to find their agency.

We’ve taken a look at the data. And we’ve noticed interesting trends that could indicate where marketing is headed, now that we are slowly getting back to a pre-pandemic life.

Here are the main findings we discovered :

- Food, e-commerce, & the clothing industry are the top 3 sectors that are investing the most in marketing right now.

- As of today, the most popular marketing expertises are digital strategy, website creation, & advertising.

- There is a difference in the average marketing budget of companies based on their location and the expertise they invest in.

- Marketing investments slow down during the summer months before resurfacing for the final quarter of the year

Those findings are based on the data our platform has gathered on companies posting projects on Sortlist since January 1st, 2021.

You Won’t Believe Which Industries Invest The Most in Marketing Before the Summer

Although we have seen an upward growth of 9.4% of projects across all expertises on a monthly basis at Sortlist since the beginning of the year, the summer months always call for a dip in investments. We expect a drop of around 17% come August on a global scale.

However, there are no valleys without hills and September has proven to be the month of marketing investments and big changes for companies with an increase of 25% of projects at Sortlist.

Within our three most popular sectors this year, previous years have shown us that we are expected to see the same trends in almost all the countries.

Food

Since January 1st of 2021, Sortlist received more than 720 projects coming from food companies.

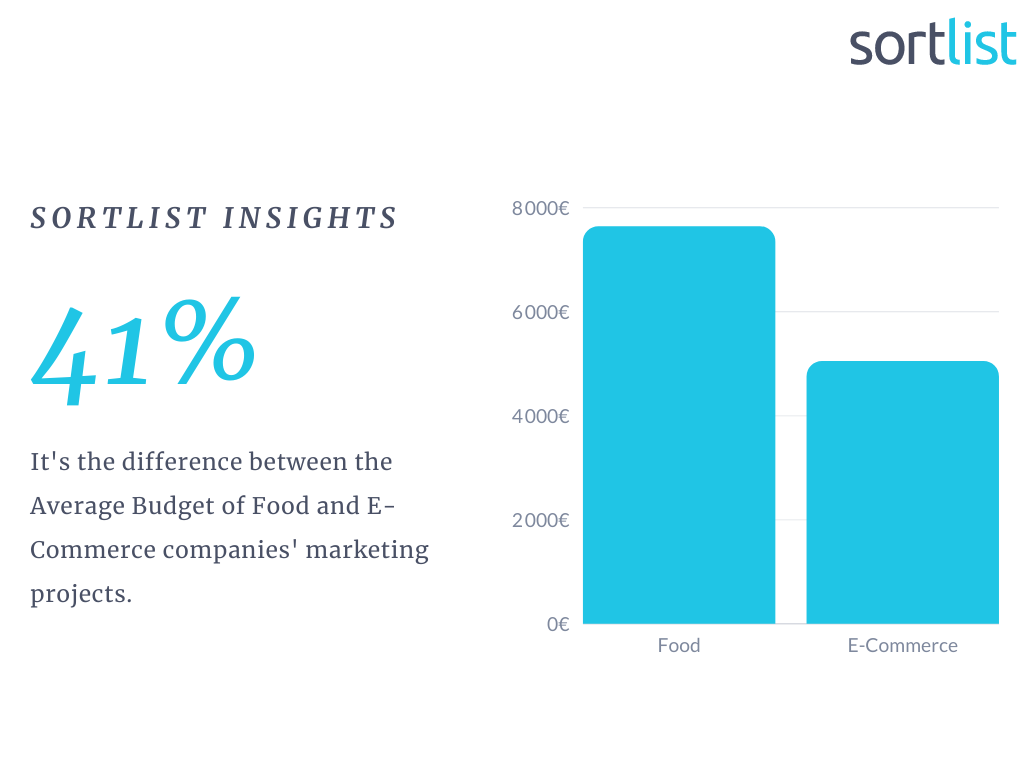

The food industry is the sector that invested the most in marketing since the beginning of 2021, with an average budget of 7,637€ per project.

With the different sanitary restrictions we’ve known since March 2020, companies working in the food industry had many challenges to face. And in order to overcome these challenges, they’ve been actively looking for digital solutions and partners.

Based on our data, food companies tend to invest in 4 main marketing expertises :

- Branding & positioning

- Digital strategy

- Advertising

- Social media

Although we have had some impressive numbers at the start of this year, across the various countries, we can now expect a slow down of projects before a significant increase after the summer months in all countries except Germany with up to 92.86% in Spain.

Our take is the following: food companies are supporting heavy investments to adapt to the new normal. With take-outs and deliveries, many actors of the food industry such as restaurants had to become digital. They needed to support those investments in order to keep running.

Another phenomenon becoming massive in the food industry is dark kitchens. Those are cooking spaces in a shared warehouse aimed at food delivery businesses. Due to Covid-19 measures, dark kitchens are currently booming.

And looking at the numbers, this trend is nowhere near about to change. The food service industry is not only looking at growth in 2021 but instead, a multi-year rebound and ghost kitchens alone could be a $1trn business by 2030…

E-Commerce

Between January and June 2021, Sortlist received more than 700 e-commerce projects and we can’t say it’s a surprise.

Since 2017, e-commerce sales have shown steady growth and they’re expected to account for 18.1% of all retail sales worldwide by the end of 2021. That number should reach 22% by 2023.

And when we know that younger people shop more online than the elderly (38.4% of online shoppers in the US are under 35 years old), we can only expect e-commerce to take over in the years to come.

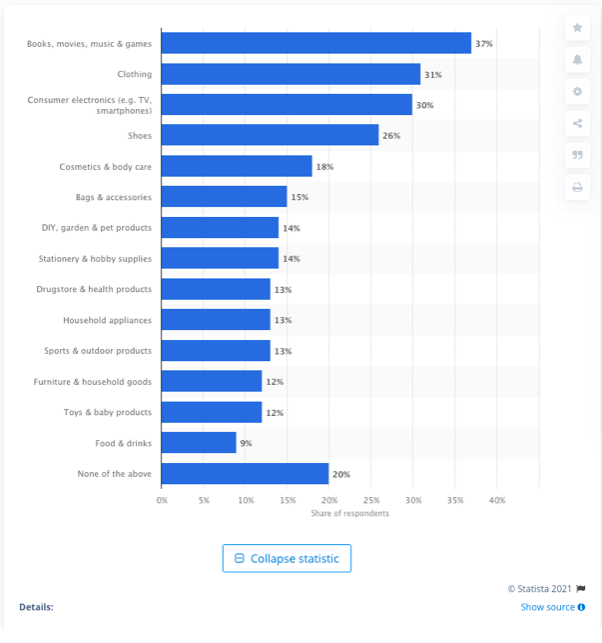

However, e-commerce growth doesn’t apply to all kinds of products. According to Statista, certain categories of items are more likely to be bought online compared to others.

Books, movies, and consumer electronics are typically the 3 main products consumers tend to buy online :

So even if e-commerce has been favored by the pandemic, offline shopping is far from dead. Especially for certain types of products, as shown by Statista’s study.

Even if we may order takeout much more now than a few years back, food and drinks account for only 9% of the likelihood of being ordered online.

We still prefer a nice meal or drinks out with our friends and family and certain marketing trends have picked up on these habits.

SoLoMo, the abbreviation of ‘Social, Local, Mobile’, is one of the newest forms of digital marketing. It combines our online and in-person habits to maxmise a company’s marketing potential.

Maybe one day we’ll be 100% digital, but for now, businesses should focus on people’s desire to explore the outside world once again after a year of confinement. For example, companies such as Foursquare and Yelp combine both an online and in-person experience for customers to engage via technology and execute an action in a physical location.

Furthermore from the Statista study, we’ve noticed two interesting trends by looking at our data :

- The average e-commerce budget is 41% lower than food companies’ projects with an amount of 5,046€.

- Almost one-third of e-commerce projects we’ve seen are either investing in digital strategy or social media, which is smart when we know that social media use increased by 78% amongst millennials and Generation Z in the past year and they spend 2 to 3 hours every day on those tools.

In terms of gearing up for the summer months, yet again Germany distinguishes itself here with their peak investment time at the beginning of the year, but nonetheless, they follow the other European countries in an upward trend of marketing investments in the third quarter.

At Sortlist, we are almost guaranteed a rise of at least 40% in e-commerce projects in Belgium, France, the Netherlands, and Spain on a yearly basis.

Clothing & Accessories

Finally, the clothing & accessories Industry is the third most active sector since the beginning of 2021, with more than 600 projects.

Although we are already seeing some nice high numbers at the beginning of the year, across multiple countries, the beginning of the third quarter of the year usually shows signs of an increase in marketing investments, particularly in France with an increase of 120% of projects compared to the previous two months.

Belgium seems to start its peak slightly earlier but in Germany, the best marketing investments months seemed to already be behind us.

On average, clothing companies have been spending 6,300€ per project, investing in three expertises in particular:

- Digital strategy

- E-commerce creation

- Social media

We’re expecting to see clothing companies invest more and more in those expertises.

But at Sortlist, we were not the only ones to observe this increase in marketing investments in the fashion industry. Soline Demenois, Lead Partner Marketing Manager at Stylight, observed:

While 2020 accelerated the digitalisation of many fashion brands, 2021 reached new heights: we noticed that our partners increased their marketing budgets by over 32% in the first half of 2021 compared to H1 2020. Taking in consideration this year-over-year growth and the fact that online shops are getting ready for holiday shopping earlier and earlier, Q3 2021 is shaping out to be a strong quarter for online marketing in the fashion industry

With this digitalisation, we have witnessed the development of short-form video content on platforms like TikTok and Instagram and we are now entering an era of native e-commerce from which clothing brands will take advantage of.

According to Connie Chan, General Partner at Andreessen Horowitz and expert in consumer tech, the future of clothes shopping will be interactive. Instead of scrolling through pictures or navigating in different categories, consumers will be watching a model presenting different outfits. Each of those outfits being purchasable.

On Douyin, the Chinese version of TikTok, this is already the status quo for fashion influencers.

They showcase 5 to 10 outfits in 15 seconds video clips, from which users can directly purchase.

One example of a successful brand that leveraged TikTok is ASOS.

ASOS has a strong Millennial and Gen Z following. The brand successfully launched four marketing campaigns on TikTok, which generated 15 billion views. One-third of them were coming from the North American market, driving brand recognition and revenue.

According to Forbes, ASOS saw an increase of 24% in sales and an increase of 275% in profit for the first half of its fiscal year ending February 28, 2021.

Furthermore, tools such as Livescale and UseHero now allow brands to leverage live shopping in order to boost their sales. Thanks to livestreaming, retailers can present their products and directly give advice to their clients.

In this case study, we learn how a jewelry brand leveraged live shopping as a new way of selling its accessories.

The clothing & accessories industry will have a lot of digital evolution to go through in the years to come and we believe agencies will play a role in those evolutions.

Differences Between Countries

While food, e-commerce, and the clothing industry are the 3 most active sectors from a global point of view, it’s not necessarily the case in each market. Depending on the country we’re looking at, the situation can be different.

France

In France, the top 3 industries who’ve been posting the most projects on Sortlist since the beginning of 2021 are the following:

- E-Commerce

- Clothing & accessories

- Food

The trend is similar, but not exactly the same in comparison to the global situation.

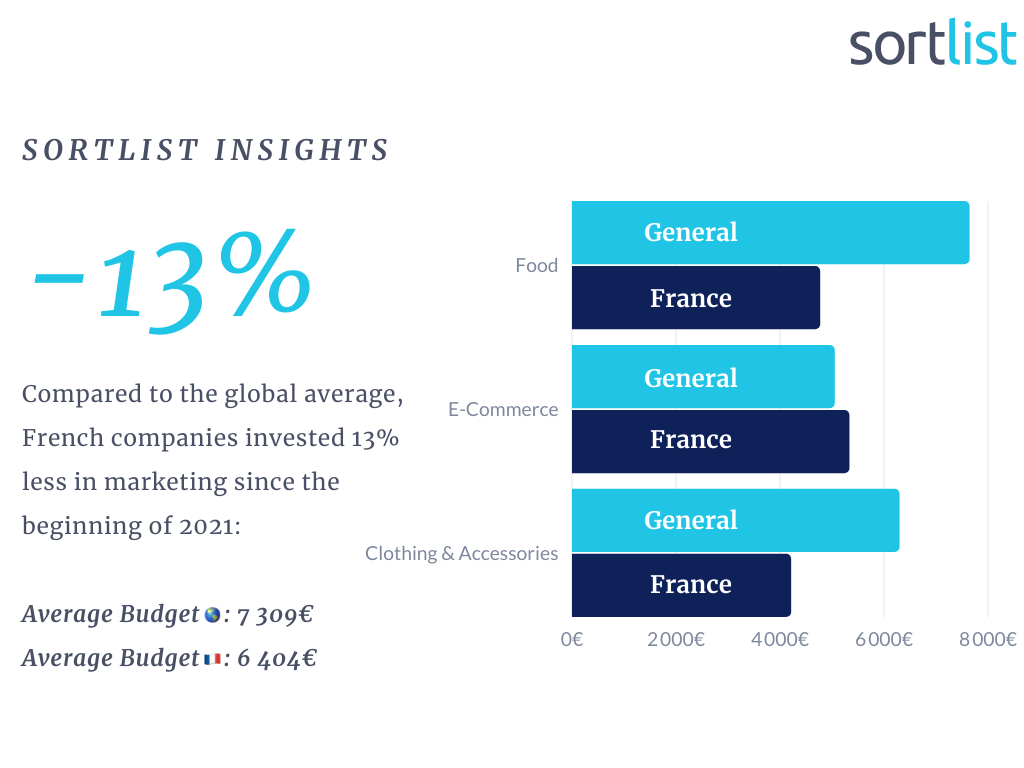

Furthermore, we can also notice a difference in the budgets of French companies compared to the general average :

As we can see on the graph, the industry that has the highest marketing spending in France is e-commerce, with an average budget of 5 327€ per project.

However, French companies did invest 13% less than the global average.

Spain

The situation in Spain is similar. We find the same top 3 industries, but in a different order :

- E-commerce

- Food

- Clothing & accessories

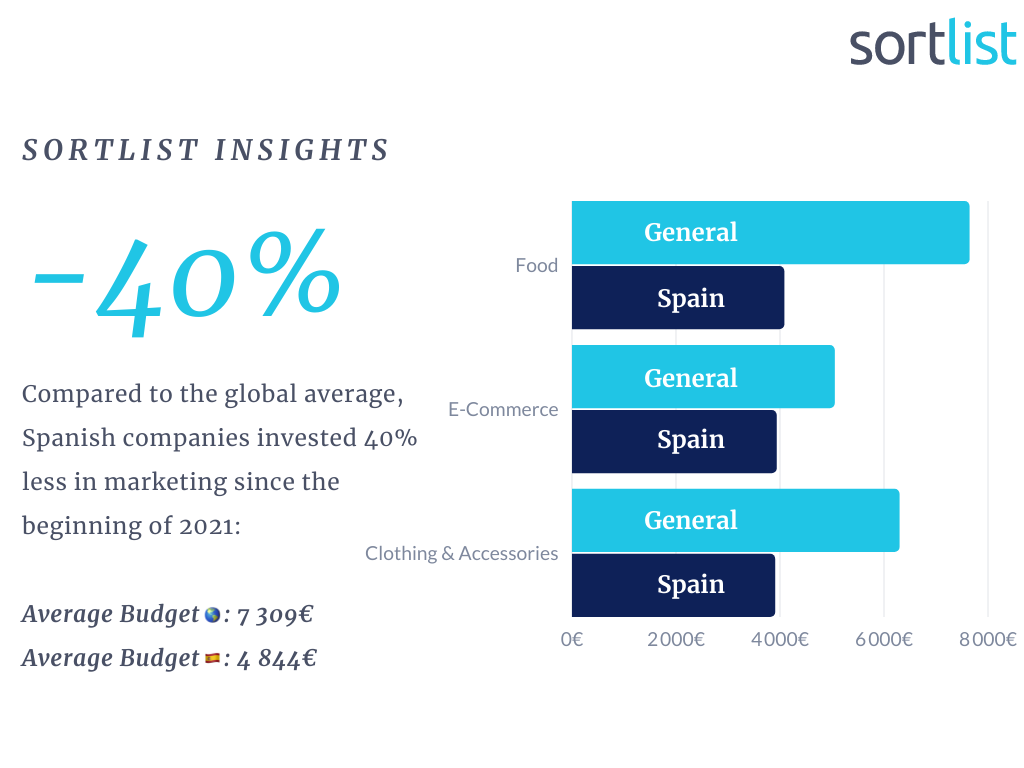

However, we did notice a big difference in the average budgets :

What’s also interesting to notice is the following: all three industries have a similar budget of around 4,000€ per project on average.

But between the three, the food industry takes the crown, with 4,080€.

However, Spanish companies did invest 40% less than the global average.

As a country that has never fully recovered from the 2008 financial crisis, although doing much better in recent years, the country has always had to be more cautious in terms of investments. With the Covid-19 pandemic, certain efforts in getting the country back on track have been set back and the country was faced at the end of 2020 with the lowest GDP since the civil war.

However, this tendency is on the verge of change with already record-breaking investment numbers in the first two quarters of 2021 compared to previous years.

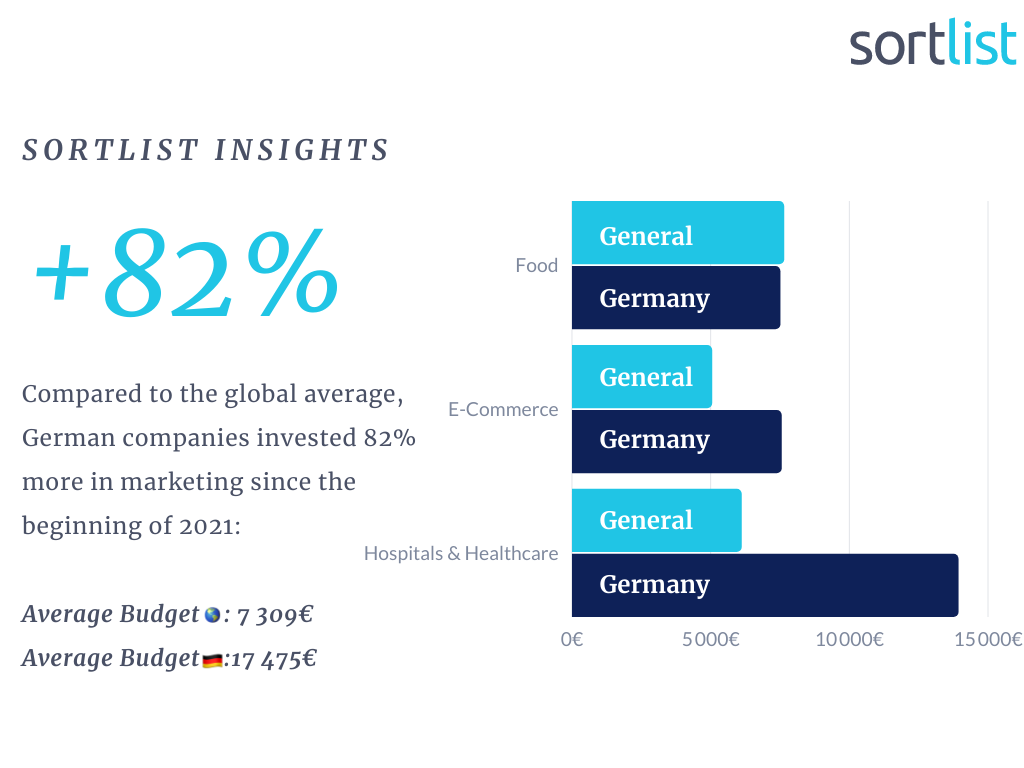

Germany

The German market presents different trends. First of all, the top 3 of most active industries on Sortlist is different, with a new sector coming in:

- E-commerce

- Hospitals & healthcare

- Food

Furthermore, we notice a big difference in the average budget spent in Germany, compared to the general trend:  As we can see on the graph, the industry that has the highest marketing spending in Germany is hospitals & healthcare. And it is by far, with an average budget of 13,922€ per project.

As we can see on the graph, the industry that has the highest marketing spending in Germany is hospitals & healthcare. And it is by far, with an average budget of 13,922€ per project.

Furthermore, German companies did invest 82% more than the global average.

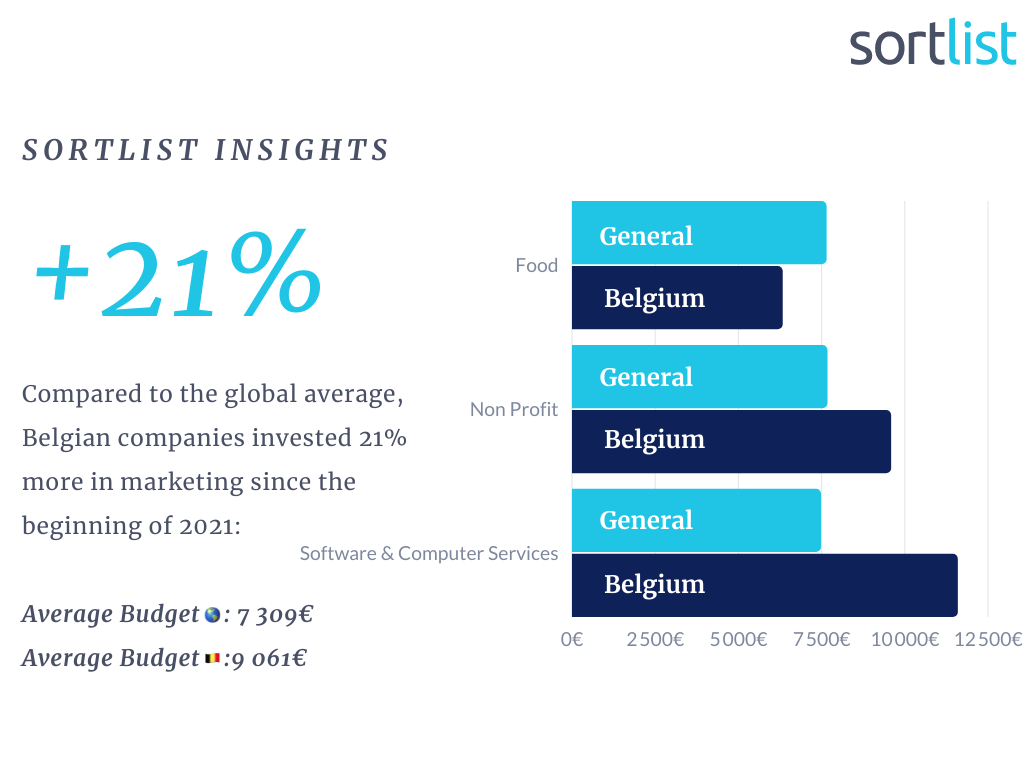

Belgium

The Belgian market also presents diverging trends. Just like Germany, we notice a difference in the top 3 of most active industries on Sortlist :

- Food

- Non profit

- Software & computer services

Furthermore, we notice a difference in the average budget spent by Belgian companies:

As we can see on the graph, the industry that has the highest marketing spending in Belgium is by far Software & Computer Services with an average budget of 11 580€ per project.

Furthermore, Belgian companies did invest 21% more than the global average.

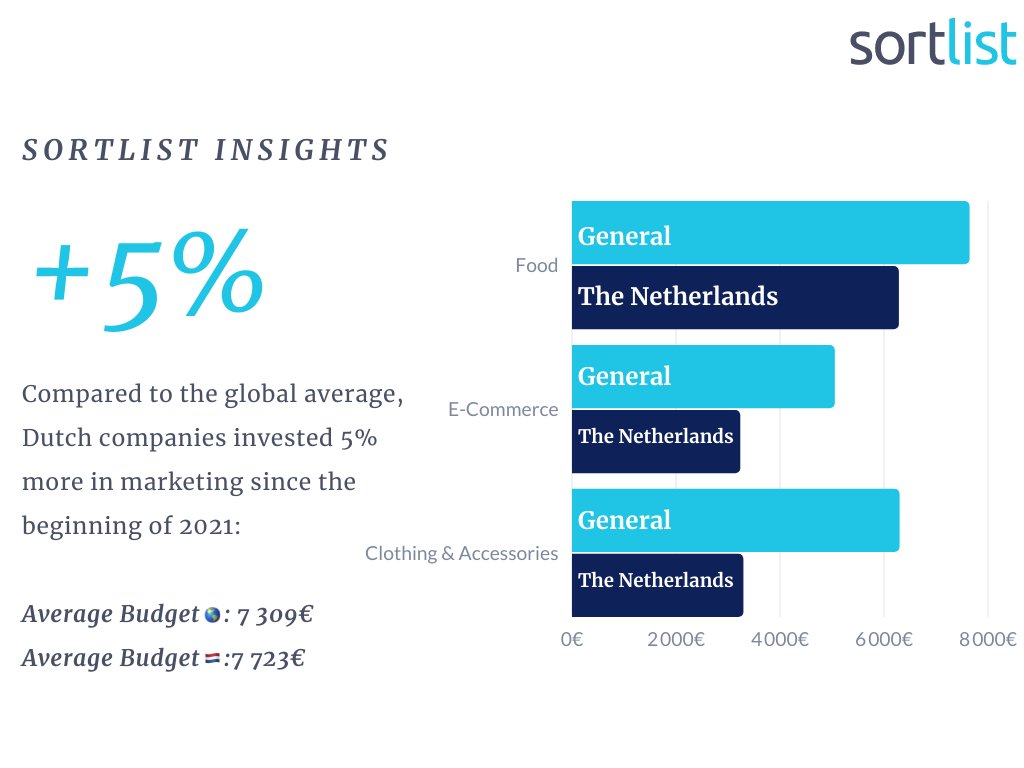

The Netherlands

In The Netherlands, the situation is quite similar to the general trend. We have the same top 3 industries:

- Clothing & accessories

- Food

- E-commerce

While budgets are quite similar to the average budget presented at the beginning of the article:

As we can see on the graph, the industry that has the highest marketing spending in The Netherlands is Food, with an average budget of 7 723€ per project.

Furthermore, Dutch companies did invest 5% more than the global average.

Conclusion

During these first 6 months of 2021, we’ve noticed that companies active in the food, e-commerce, and clothing industries have been investing the most in their marketing strategies.

And after looking at the data, we can expect those industries to be leading the post-pandemic digitalization trend, but most probably after they take some time off during the summer months.