The End of Tesla? | Tesla SWOT Analysis – Finding the Faults

Last update: 30 August 2023 at 03:25 pm

Tesla comes to mind when you think of electric, futuristic driving. Its engineers have had one aim in mind since 2003: to convince the world that electric cars are the future — and that you don’t have to sacrifice to use one.

Tesla has made headlines for being the first major automaker to create all-electric vehicles, and now for becoming the largest business ever to be admitted to the S&P 500.

A SWOT analysis, which examines a company’s strengths, weaknesses, opportunities, and threats, might assist a potential automobile buyer in determining whether Tesla is worth the hype and price tag.

A Tesla SWOT analysis will provide you with a better picture of how it works and what it plans to do in the future.

The Birth of Tesla

Nikola Tesla, a prominent scientist, and inventor was the inspiration for Tesla Inc., which was formed in 2003. The brand has become one of the top car businesses in the world because of its energy-saving strategy and luxury-focused designs.

In February 2004, Elon Musk met with Martin Eberhard and Marc Tarpenning, the original creators of Tesla Motors (previous name), and donated US$6.5 million to the initial US$7.5 million round of financing.

Tesla’s eco-friendly energy concept changed the car industry and had a major worldwide influence.

Tesla Roadster, Tesla’s first car, was the first automobile to employ lithium-ion cells.

Today, the company has services on motor vehicles, auto service, financial services, energy storage, solar panels, lifestyle products, and retail merchandise through the agency of its subsidiary companies called SolarCity, Tesla Grohmann Automation, Maxwell Technologies, DeepScale, Hibar Systems.

Tesla, based in California, has grown in popularity among the American public as a high-end electric vehicle with an original design.

Tesla SWOT Analysis: Strengths

Unlike any other automotive players in the market, Tesla isn’t just concerned with the sale of automobiles. Its ambition is far more than that: it wants to completely transform the driving experience.

They’ve begun by providing electric automobiles.

Tesla is typically the first business that comes to mind when discussing electric cars, even though they are not the only company selling these sorts of vehicles.

Rather than focusing on making inexpensive electric cars for the general population, Tesla went the other path. It is aiming for a specific market segment: the high-end electric vehicle market. There were no other companies in this sector when the firm began over 20 years ago.

Below are some of Tesla’s strengths that assist it in achieving its purpose.

Strong Brand Authority For Premium Electric Vehicles

The importance of a company’s brand cannot be overstated. A firm may almost become synonymous with the industry it is seeking to corner if the ideal storm of early acceptance, innovation, consumer demand, and continuing popularity strikes.

Consider Kleenex, Band-Aid, or even Google: their names are so strongly associated with their products that they are almost interchangeable.

If you are looking to build your business’ authority, consider working with a qualified branding agency to help you cement your brand in its field.

The Largest Market Share in Luxury Electric Cars

Tesla has a near-complete monopoly on the luxury electric transport market.

While other car manufacturers such as Nissan, Toyota, and Honda have established household brands for low-cost electric vehicles, Tesla is the only one aiming for high-end electric luxury vehicles.

It has a monopoly on the market and has no competitors, providing it with an immediate competitive advantage. Those car buyers that buy a Tesla get status as a result of this also Tesla’s premium quality assurance.

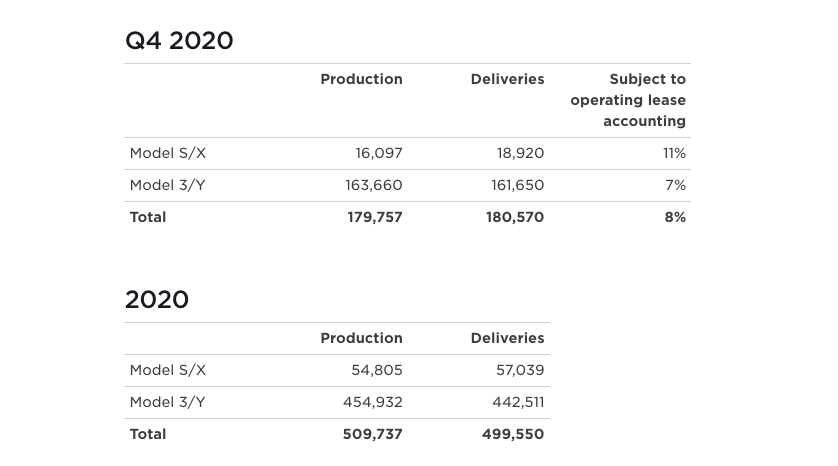

In the fourth quarter of 2020, Tesla delivered 180,570 electric vehicles and manufactured 179,757. This is a significant increase from the previous highest quarter of 139,300 in the third quarter of 2020.

Good Work Environment For Employees

The people hired by a company can make or break it. Tesla is recognized for not just employing the best people, but also for treating them well after they’ve joined the family.

Tesla is a firm that thrives on new ideas and encourages its employees to do the same. It has been named one of the finest places to work, having a high retention percentage of employees.

Largest Proportion Of Electric Cars in the United States

Being the sole significant participant in the industry has several advantages, including strong sales.

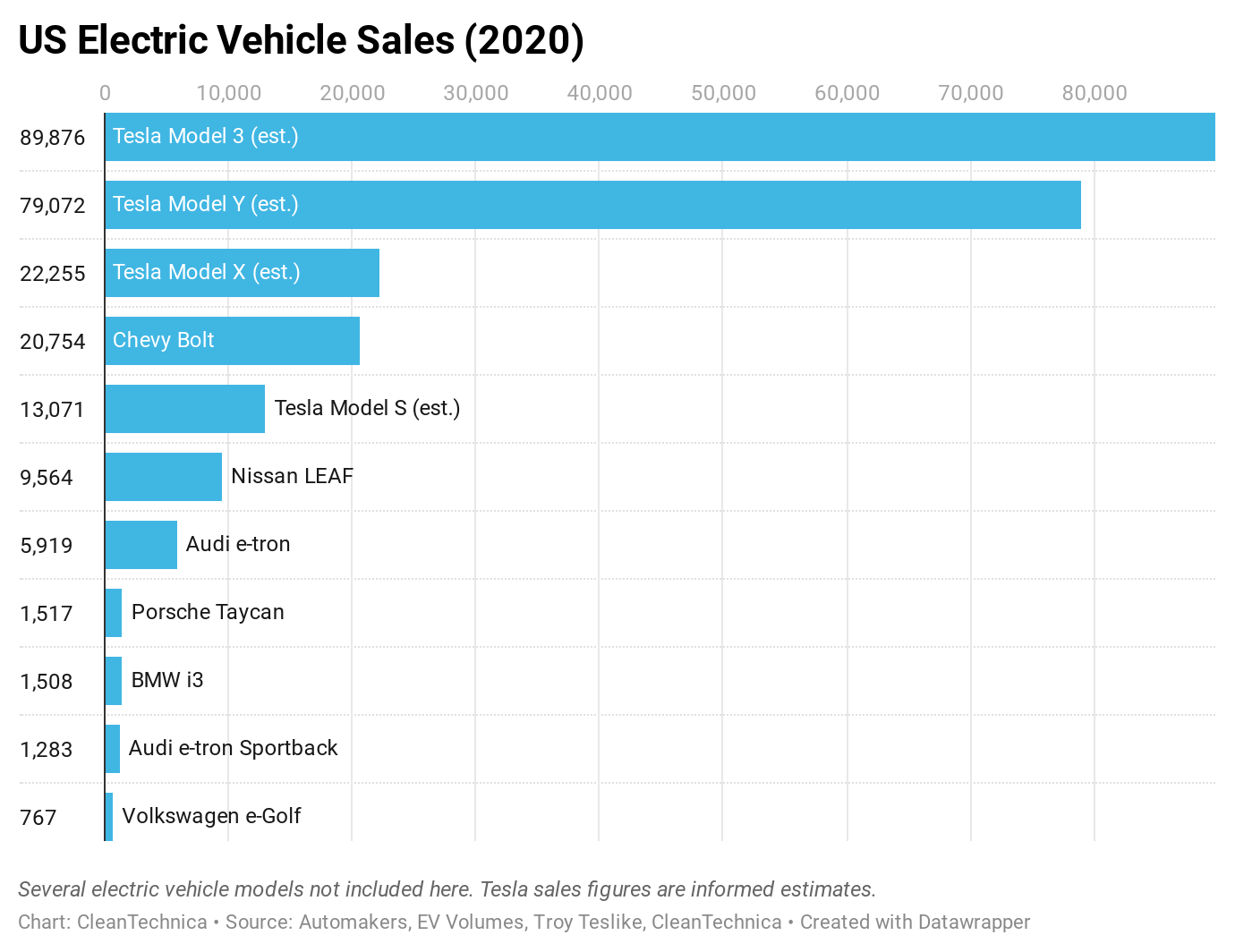

Tesla is the leading electric car technology manufacturer in the world. When it comes to more electric vehicles sales, even much larger companies like Chevrolet just cannot compete with Tesla.

It also has higher revenue statistics, indicating that it is not only selling a larger number of automobiles, but also a higher overall worth of vehicles. It will be crucial to maintain this market share over time, but for now, Tesla is the one to beat.

Tesla SWOT Analysis: Weaknesses

These internal factors are weaknesses that can reduce Tesla’s competitiveness and business growth.

In the context of this business analysis, weaknesses are issues that the company must overcome through strategies, reforms, and initiatives. Let’s take a look at some of Tesla’s weaknesses.

Demand is Larger Than Supply

Manufacturing services in-house may be both a benefit and a curse. While a firm can assure quality by producing all of its components, it must also ensure that it can fulfill consumer expectations.

Tesla has much fewer manufacturing hubs than larger, more established manufacturers, which limits the number of vehicles it can build. To keep up with demand, it will need to add more sites.

Tesla fell short of its yearly delivery goal in 2020, delivering 499,550 units vs its stated goal of 500,000.

Limited Supply of Crucial Car Components

Tesla became the world’s greatest user of batteries rapidly, and they all originate from the same place.

The battery production technology is the most crucial component for an electric automaker, and when supplies run low, manufacturing is virtually halted.

Given the company’s nature, this bottleneck is to be expected, but Tesla will be constrained by its limited supply until it can effectively solve the problem.

Tesla Is a One-person Operation

When you mention the word “Tesla,” many people will automatically think of its famous billionaire founder, CEO Elon Musk. It’s unclear if Tesla would have direction or leadership without Elon Musk. Tesla is, in a way, Musk.

Overpriced and Out of Reach For the Average Customer

Tesla has positioned itself as a premium manufacturer for a certain, and limited, segment of the market.

Luxury automobiles are usually out of reach for broad portions of the population, putting the firm at a disadvantage. Many individuals are hesitant to get on the electric car bandwagon due to the expensive cost.

Tesla SWOT Analysis: Opportunities

The company’s name, strong brand image, and influence give it a leg up. Let’s have a look at some of the possibilities.

Future Gigafactory: Taking Advantage Of Economies Of Scale

Tesla now employs only one production facility to produce all of its cars. This drastically restricts the number of automobiles it can produce. Tesla understands that it needs more factories to manufacture and sell more.

It is investing in a “gigafactory” idea to enable it to fulfill the demands of a rising market and to position the firm to compete on production scales with other major automobile makers.

This might lead to higher market penetration rates, especially as customers grow more accepting of electric automobile technology.

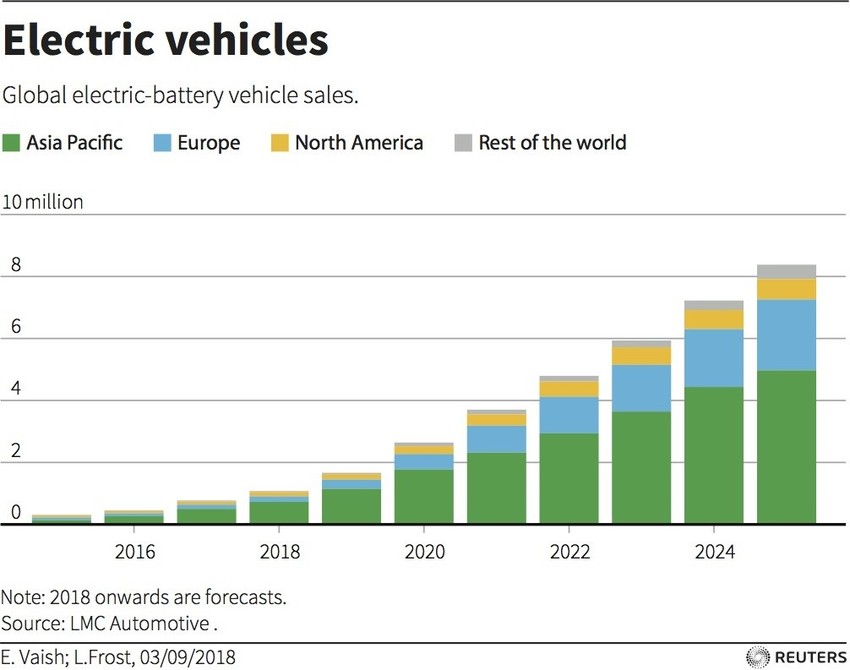

Asian Market Offers Billions Of Potential Clients

Asian countries are a huge target for businesses all around the world, including automobile manufacturers. They are rushing to these countries in the hopes of reaching new sectors of vehicle consumers, with billions of potential customers.

Tesla is ideally positioned to strengthen its position in Asian markets, which may contribute to its bottom line and offer it a real incentive to increase its manufacturing capacity, thanks to its already flourishing reputation for excellence in electric automobiles.

At The Forefront Of Self-driving Technology

Tesla is one of the top marques in self-driving technology as it pushes the boundaries of electric power. This extra invention, like SpaceX’s, not only boosts its public impression of technological skills but also opens up a new industry if it can safely master true self-driving vehicles.

Teslas have a new technology autopilot feature that allows the car to steer, accelerate, and brake automatically in the lane it is in, but you definitely shouldn’t fall asleep behind the wheel and let the car drive itself.

Buying A Tesla Implies Helping The Environment, Which Many Customers Appreciate

Tesla has focused a lot of its marketing and public relations efforts on its sustainable energy and environmental commitment.

As a consequence, vehicle owners value the environmental friendliness of their vehicles. Tesla has become the poster child for how changing the status quo is feasible as more and more countries turn to sustainable measures and approaches.

Tesla SWOT Analysis: Threats

External factors and internal factors that might jeopardize or impede the company’s process are considered threats. Let us have a look at some of Tesla’s threats.

Increased Competition From Big Automobile Companies

While Tesla dominates the electric vehicle industry, other manufacturers are catching up. Furthermore, in some circumstances, other firms may be able to provide less-priced versions than Tesla.

Tesla will have to do more to stand out and justify its price tag as emissions rules continue to move and change, and as other businesses adopt this method to car production and enter this expanding industry.

Self-driving Cars May Or May Not Be Accepted By Consumers Shortly

Despite advancements in the technology necessary for autopilot vehicles, the general public is still not ready to embrace the concept of self-driving cars.

Potential buyers are concerned about personal safety and the “ethical” judgments that automobiles are designed to make in the event of many tragedies.

Furthermore, the risk of system breakdowns and malfunctions renders this technology a non-starter for the time being.

Tesla Has A History Of Producing Faulty Components

Every new invention has its setbacks, and Tesla is no different. It has a variety of difficulties with those components since it uses so many proprietary items in its automobiles.

The different parts used to construct Tesla’s automobiles have had significant product liability claims due to poor design, inconsistent performance, and even incorrect execution. There is a need for more real-world testing and component enhancement.

Wrap Up

Tesla is a ground-breaking car business dedicated to transforming the future of the transportation and automobile industry.

Not only do they create luxury, environmentally friendly, and innovative automotive for the rich, but they’re also pioneering autonomous driving.

A few obstacles lie in the path of the company’s success. Tesla invests tens of millions of dollars in research, production process, and development.

This is the price of being a technology trailblazer. Unfortunately, this has resulted in hundreds of millions of dollars in debt. Tesla is still attempting to pay it down over 20 years later.

They’ve also only recently established new plants capable of producing large quantities of profitable products. This is similarly expensive but crucial for Tesla’s expansion. Despite the difficulties, in conclusion, Tesla shows no signs of slowing down.