5 Steps to a Thorough External Analysis and Which Tools to Use

Last update: 29 February 2024 at 09:05 am

Your business functions in an ever-changing world. There are factors outside of your control. Like a ship at sea, your business is at the mercy of an ever-changing tide of buyer habits and economic trends. Your business strategy needs to include external analysis.

External and internal analyses complement each other. Both are vital in developing strategies that will get your business off the ground.

This article will answer your biggest question. Why is it necessary to perform an external analysis?

Key Takeaways

- External factors like buyer habits and economic trends shape business strategy.

- External analysis complements internal analysis for effective planning.

Importance of External Analysis:

- Identifies industry opportunities and threats for informed decision-making.

External Analysis Tools:

- SWOT, PEST, and Porter’s Five Forces models assess industry competitiveness.

Conducting External Analysis:

- Analyse supply chain, identify strategic groups, run comprehensive analysis, and research global markets.

What is the Difference Between External and Internal Analysis

A competitive environment and foreign trade regulations are factors that affect your company. These factors present threats and opportunities that your company needs to identify.

For example, think of the financial sector and its competitors. Automakers sell insurance and provide financing now. Financial markets began to struggle because of this.

An external analysis could have helped foresee the threat presented and allowed planning to prevent the impact. Once you identify them, you can start planning.

Hence, an external analysis examines the industry environment of your company.

The main goal of the external analysis is to identify opportunities and threats. It’s about understanding the environment of your industry competition.

What does external analysis include? It includes an assessment of the firm’s strategic competitiveness. This can include areas like competitive structure or position in markets. On a larger scale, it includes macroeconomic analysis. Demographics like political, global, social, and technological are all part of external analysis.

While external analysis looks at outside factors, the internal analysis focuses on what’s within.

Analyzing internal factors will focus on your strengths and weaknesses. The goal is to identify internal strategic strengths and weaknesses. After that, you can develop a strategy that leverages those factors.

Do you want to dominate your target market with a strong strategy? Analysing both internal and external factors is key to developing a strong strategy.

What Are External Analysis Tools?

Several tools examine industry characteristics. They support industry analysis and achieve strategic competitiveness for your company.

You should conduct both current and future strategies and the industry’s profit potential. Depending on the objectives you decide on, you should choose the tool that best fits your needs.

SWOT Analysis

Successful companies gather information from all factors in what is a SWOT Analysis. This method forces industry analysis of factors that are both internal and external.

You’re then presented with a summarised list of your company’s data. This data includes strengths, weaknesses, opportunities, and threats. After you have data, you can begin a developing strategy that outshines your competitors.

If you require any additional help going through your company data, don’t hesitate to ask for some help from a qualified data consulting agency.

What makes this strategy strong is that you pair opportunities to strengths. With your weakness market analysis, a strategy that leaves few competitive threats.

Check out our Tesla SWOT analysis to have a better idea of how it works.

The PEST Analysis

The PEST is an external environment analysis framework. It helps identify external opportunities and threats in your market. It examines the external factors affecting the industry’s environment.

These factors are the political, economic, social, and technological environments.

Unlike the SWOT analysis, this strategy is all about external influences. These factors impact making decisions, industry growth, and expansion.

Political influences are ones like entry barriers on the international fronts. They also include things like laws and policies, governing bodies, and officials. Economic influences include economic climate, taxation, exchange rates, and globalisation.

Customers’ opinions about your product are part of the social analysis. The changing population, demographics, and attitudes are also social influences.

Finally, the last area is the technology and how it impacts your business. You should focus on the government and industry’s level of interest in your industry.

All these components combined to create the PEST analysis.

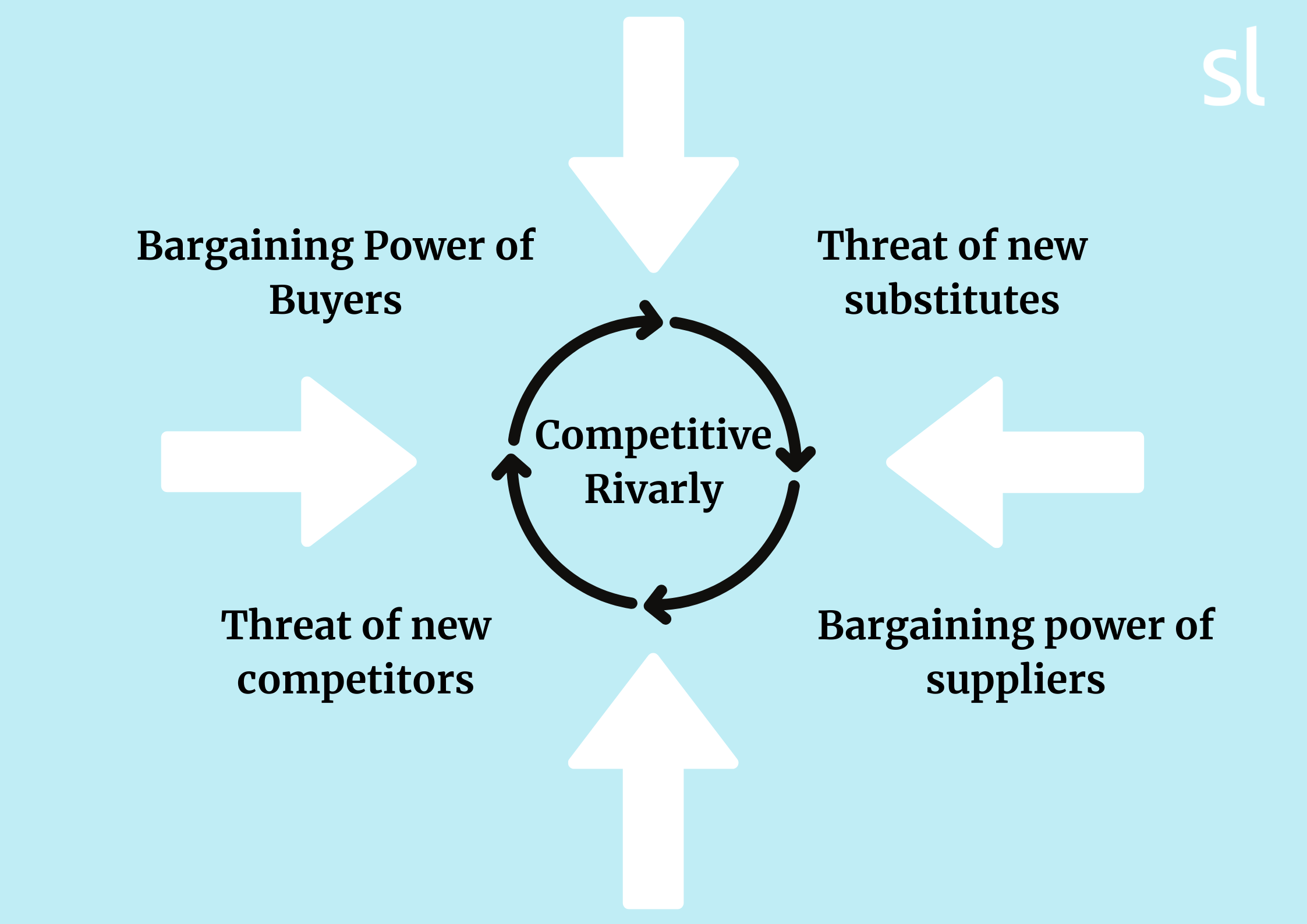

Porter’s Five Forces Model Of Market Structure Figure

Porter’s five forces analyse opportunities that affect a business as well as threats. There are five factors, as the name implies, that influence a business’ direction.

Force 1

The first force is the threat of new competitors to the industry. Competitive engagements reduce profitability. New competition can force existing firms to spend money on costly rivalries.

The higher the entry barriers are, the smaller the threat to existing firms. New players in the commercial aircraft industry have to scale high barriers of cost. These barriers include obtaining planes, licensing, and insurance.

Force 2

Suppliers also have control over and impact your business. This force is about analysing the bargaining power of suppliers.

The gasoline sales market is largely governed by the supply and demand of the fuel. Suppliers have more control of the distribution system. When key external environmental forces drive supply down, suppliers can drive high prices. Relevant consumer laws can protect your business in this situation from unfair prices.

Force 3

The bargaining power of buyers is the next force that this tool analyses. Customers have more power when the market isn’t flooded with buyers. In the retail jewelry business, vendors have customers with high bargaining power.

This is because it’s a niche business with fewer customers as only a set amount of people wear or buy jewelry.

Force 4

The threat of products that substitute yours is another force that impacts business. If only a few firms have products or services like yours, this force less impacts your business.

But if your industry is something like coffee or food, you may have many products that are like yours. If a product’s quality and performance capabilities are greater than your own, you’ll lose to competitors.

Force 5

The last force that Porter examines is the rivalry between competitors. Competition is everywhere; airlines sell mutual funds, which compete with personal financial services.

Companies continue competing even if they experience slow industry growth. That is because slow growth markets may have a high exit barrier, which is costly to leave.

How To Conduct A Thorough External Analysis in 5 Steps

To take you through the steps of an external analysis, let’s look at two important terms, industry and market segments. The industry market structure includes competitors’ competing for profits. The electrical utility industry competes with regional utility companies, for example.

Market segments are groups of customers within a certain market. These segments can separate into geographical, demographical, and behavior categories.

The consumer electronics market segments its consumers based on how people use their phones. Segments can include those who use their phones as cameras versus those who use their phones to talk.

Analyse Your Supply Chain

Your company should start analysing its supply chain. Your supply chain is the system that converts raw materials into finishing products. It also handles the transportation of these products from supplier to customer.

The supply chain for the global automobile industry would include materials for the entire car. From tires to seats, this material goes from suppliers to manufacturers. The next leg would be taking the finished cars from the supply line to the car lot for shoppers to buy.

Identify Strategic Groups

Strategic groups are classified by market segments, product quality, and pricing quality.

Customers can view products in the same strategic group as direct substitutes of each other. Creating a strategic group map helps in pursuing strategic competitiveness.

Run A Comprehensive Analysis

This is where your PEST and other analysis frameworks will come in handy. Arm yourself with resource data on employees, product portfolio analysis capabilities, and competition.

You should upstream and downstream markets related to your organisation’s enterprise. Key industry stakeholders will also want data on how they affect the company.

Research Global Markets

Expanding into international markets enhances your profit margin. You should conduct analysis in other countries’ markets. It lets you know about the long-term prospect for the economy’s gross domestic product or GDP.

International pressure groups affect your business too. This is especially true if they no longer restrict industry structures. Explore local lifestyle trends and see how a domestic partner benefits from these new insights.

Ask The Right Questions

Part of conducting a successful analysis is all about asking the right questions. Let’s use the PEST model to craft a few questions that may help you create your strategy.

Think about the five influences and create questions in those categories. What trading laws exist that could impact your business? The environmental and social attitudes that can affect, say, an oil production market? What about how an epidemic affects the pharmaceutical industry?

These questions provoke thought and research that will help you identify where your focus should be for business.

|

Discover the most relevant agencies for your project based on your own specific requirements.

Find an agency!Why Is External Analysis Important?

You will gain a competitive advantage by understanding what factors can affect profits and growth. An environmental analysis tells you what laws and policies may impact your business. External analysis is about asking the right questions and doing the right research.

Bolstering your organisation against external influences will give you a strong market share. Leveraging the right data will help your organisation plan resources with efficiency. Prepare your company for success with targeted market leadership aided by external analysis.

You’ll thank yourself for investing in it.

FAQs

Internal and external issues analysis involves examining factors within and outside of an organisation that can impact its operations, performance, and strategic decisions. Internal issues relate to strengths and weaknesses within the organisation, while external issues pertain to opportunities and threats in the external environment.

The internal and external situation analysis involves assessing an organisation’s internal capabilities, resources, and limitations (internal analysis) as well as the external factors such as market trends, competitive landscape, and regulatory environment (external analysis). This comprehensive evaluation helps organisations identify strategic opportunities and challenges.

An example of an external factor analysis could include analysing market trends, economic conditions, technological advancements, regulatory changes, and competitive dynamics. For instance, a retail company might analyse consumer spending patterns, industry trends, and competitor strategies to understand external factors influencing its business.

The three levels of external analysis typically include the macro-environmental level, industry level, and competitive level. The macro-environmental level examines broad societal, economic, political, and technological trends. The industry level focuses on the specific industry in which the organisation operates, analysing factors like market growth, barriers to entry, and supplier power. The competitive level involves analysing the organisation’s direct competitors and their strategies.